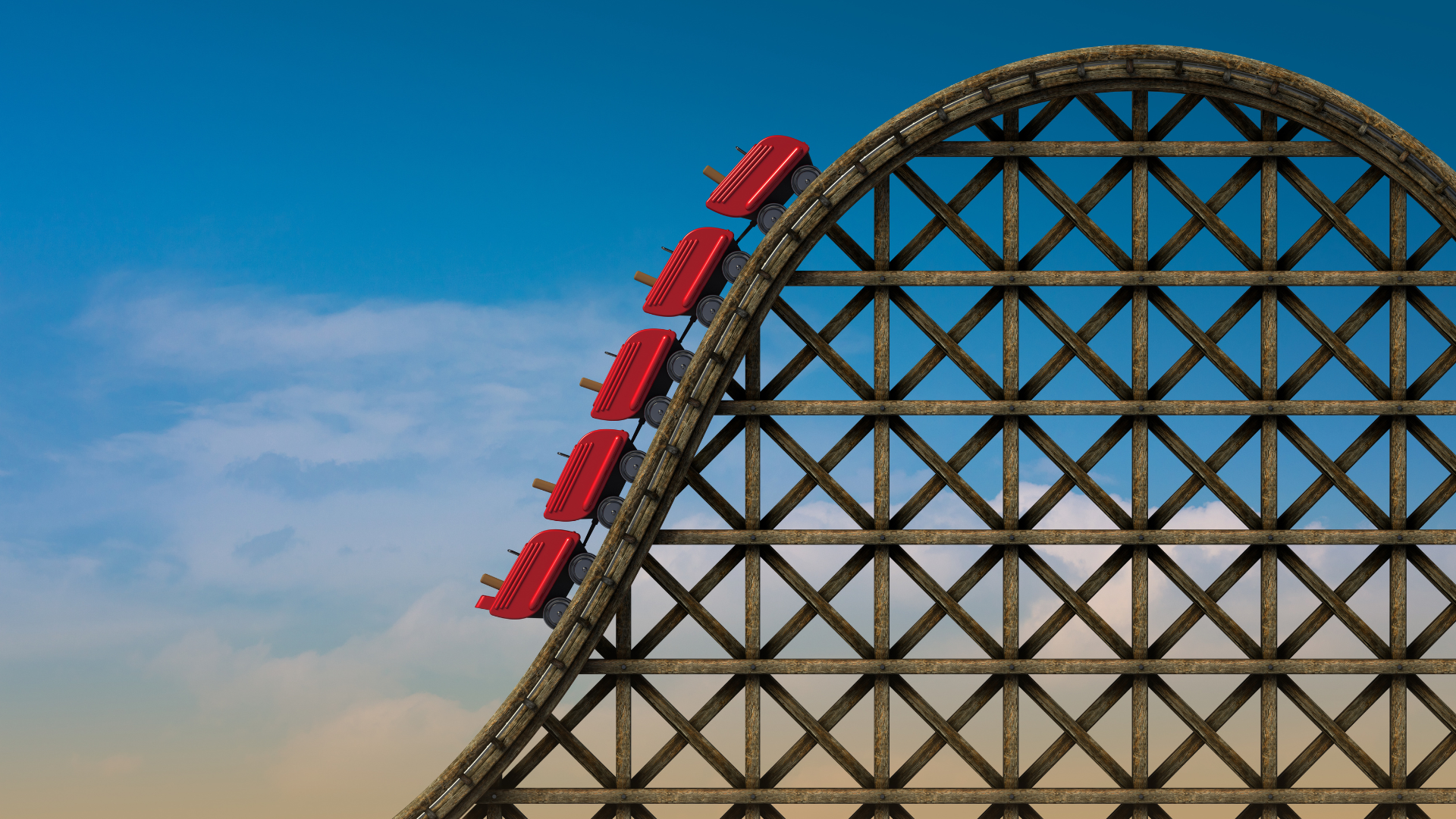

Riding the Stock Market Roller Coaster, Guest Article by Nick Daugherty of FinancialCop

Date:Friday October 21, 2022

In our class “Building Financial Strength in FIRST RESPONDER Families” we tell a quote we’ve heard Dave Ramsey refer to many of times “The only people that get hurt on a roller coaster are the people who jump off” and this quote specifically refers to the roller coaster that the stock market can be.

For example, it was a little crazy during the 1st quarter of 2018, with the volatility and the roller coaster had some crazy ups and downs. April 4th, 2018 we saw the stock market recover from a 500-point deficit to turn positive (up over 230 points) for only the third time in the history of the stock market.

I get asked by people all the time about the stock market and what I’m doing within it. My most common answer — “riding that roller coaster”!

The market doesn’t scare me, and it shouldn’t scare you for that matter. Why are people getting scared? I blame the media for a lot of it. After all, we know all to well in the first responder industry the motto “if it doesn’t bleed it doesn’t lead.” The media loves to jump onto the hype of the bad days of the market because it drives ratings and rarely report on the good days.

Here’s a good example. Awhile back, the market closed down almost 425 points in one day, which made it one of the top stories on the national evening news that I watched. The next trading day it was up over 669 points. I watched the same nightly news show and it barely got mentioned at the 15-minute mark in its normal nightly spot where it’s covered. Why? Because up 669 points isn’t “bleeding” but down 425 points was!!

The moral of the story is that the stock market can be a roller coaster. The “DOW Jones” was started May 26, 1896. Over that 121-year roller coaster ride it has an annualized return (with dividends reinvested) of approx. 10%. The S&P roller coaster that started in 1928 also has an annualized average return of approx. 10%.

You know who I see getting hurt by the stock market even more than the ones that jump off? Those of you that aren’t even getting on the roller coaster and relying on your pension to be the sole means for retirement income! Now that’s a thought scary to me!

For more information visit www.financialcop.com

The information given herein is taken from sources that IFP Advisors, LLC, dba Independent Financial Partners (IFP), IFP Securities LLC, dba Independent Financial Partners (IFP), and it advisors believe to be reliable, but it is not guaranteed by us as to accuracy or completeness. This is for informational purposes only and in no event should be construed as an offer to sell or solicitation of an offer to buy any securities or products. Please consult your tax and/or legal advisor before implementing any tax and/or legal related strategies mentioned in this publication as IFP does not provide tax and/or legal advice. Opinions expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation, or needs of individual investors. Investment advice offered through IFP Advisors, LLC, d/b/a Independent Financial Partners (IFP), a Registered Investment Adviser. IFP and Serve & Protect Financial Texas, DBA FinancialCop LLC are not affiliated.